ABS data released today shows a decline of dwelling approvals falling 6.5% which is once again significantly lower than the number we need each year to reach the National Housing Accord target of 1.2 million homes.

“Today’s statistics are a stark reminder that we need to remove front end barriers to housing supply. This includes incentivising the states to streamline planning across the continuum including halving planning times and accelerating zoning to convert undeliverable zoned land to housing faster, streamline environmental approvals and unlocking enabling and supporting infrastructure,” said Col Dutton, National President of Urban Development Institute of Australia (UDIA).

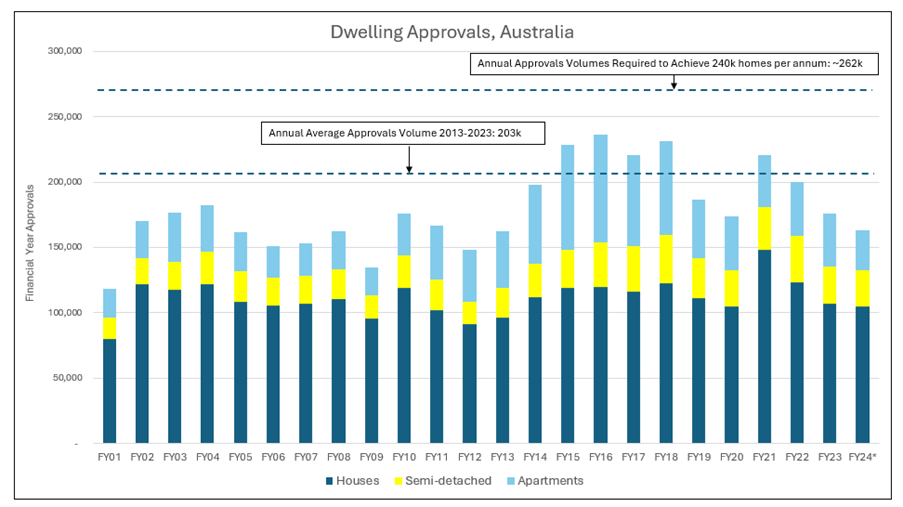

Continuing low building approvals nationally as shown in the graph below, highlight the need for Australia to redouble our efforts to boost the delivery capacity of private housing providers who we are relying on to deliver the lion’s share of the National Housing Accord Target.

Source: ABS, UDIA

When factoring in around 10% of those approvals will never result in a completed house, that means the reality is far worse than the numbers suggest.

It is also critical that we also keep up the momentum for affordable and social housing under the Housing Australia Future Fund (HAFF).

Australia’s housing markets have been beset by a continuous undersupply for most of the past two decades, eroding development ready land pipelines, housing affordability and access to home ownership. This means less houses but that cost more.

To deliver on Government’s housing initiatives including the Accord target of 1.2 million homes in five years, we must drive fundamental change across the entire housing continuum.

“UDIA will continue to work closely with governments nationally to enable the homes to be delivered for the people of Australia,” said Col Dutton

Key Statistics:

ABS dwelling approval figures released today provide June 2024 statistics on the volumes of dwelling approvals by type across the nation.

- Total approvals fell 6.5% in June driven by an 18% decrease in multi-unit approvals (seasonally adjusted).

- The on-going weakness of the multi-unit market is underscored by June approvals sitting 26% lower than the same time last year, which reflects an 18% decline in approvals on a rolling 12-month basis. Current monthly approval volumes are currently 34% lower than the decade average.

- A total of 162,070 approvals (original trend series) were recorded across FY 24 which is an 8% decrease on FY 23 with detached house approvals down 1.6%, semi-detached dwelling approvals down 3.6%, and apartment approvals down 27%.

- This nationwide annual volume of dwelling approvals is the lowest recorded since FY 12 and is 20% lower than the decade average.

- The Federal Government’s target of 1.2 million new homes over the next five years will require an average of 264,000 approvals a year – a volume never achieved in Australia and an alarming 34% higher than the approvals achieved in FY 24.

–ends

Media enquiries: Deanna Lane, Director Media & Communications UDIA