UDIA National’s flagship State of the Land 2023 Report, released today at the UDIA National Congress, illustrates an-ever growing lack of new housing supply across major capital cities and indicates Australia is likely to see a “double whammy” of even less supply fuelling ever more expensive housing in the future.

New dwelling growth has failed to keep pace with population growth over the last 15 years, creating a serious supply shortage which underlies the current rental and housing affordability crisis.

The new housing supply pipeline is retracting sharply in the face of weakened consumer demand from rising interest rates and cost of living pressures, as well as projects deferral due to ongoing construction cost escalation.

“The UDIA State of the Land 2023 report serves as the ‘canary in the coalmine’ for Governments to act now to bring new housing supply online, and ensure affordability does not degrade even further,” said Maxwell Shifman, UDIA National President. “For context, we are forecasting dwelling completions to retract sharply and head towards being 50,000 below the 200,000 annual average needed to meet the Federal Government’s plan for one million homes under the National Housing Accord,” said Mr Shifman.

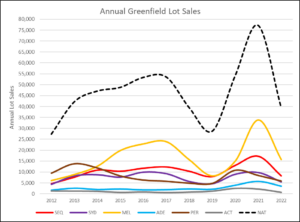

NATIONAL GREENFIELD PERFORMANCE SNAPSHOT, 2022

Source: UDIA, Research4 – UDIA State of the Land 2023

- The greenfield development sector across Australia experienced an unprecedented 49% annual reduction in sales activity in 2022 and this lead indicator shows the further major decline ahead. The predicament we find ourselves in, is in line with UDIA’s prediction in last year’s State of the Land forward outlook – “If 2022 sees similar activity levels to 2021, the result will be an acute supply shortage and a wide-spread further reduction of housing affordability”.

- All capital city greenfield markets saw a cliff-fall in annual land sales in 2022, ranging from a 70% decline in the ACT, a 54% decline in Melbourne, down to a 30% decline in Perth.

- Despite the drop off in new land sales activity, the national median lot price rose by 20% to reach $391,546, with all capitals except for Perth recording double digit median price growth.

- Responding to the greatly weakened demand profile, as well as capacity challenges felt as we exited the pandemic period, a total of just 45,357 lots were released across 2022, representing a 40% decrease on 2021 and the lowest volume of land released to market since 2019.

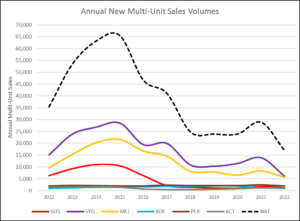

NATIONAL MULTI-UNIT PERFORMANCE SNAPSHOT, 2022

Source: UDIA, Research4 – UDIA State of the Land 2023

- The national new-build multi-unit sector experienced the lowest volume of sales in over twelve years, levels not seen since the GFC. This is an eyewatering decline in sales activity in 2022, and settled sales for new apartments and townhouses were down 34% on 2021 and 54% below the decade average.

- The 2022 sales volumes across the combined capital cities totalled just 16,780 on a 12-month rolling basis to the end of 2022, underscoring the ongoing depressed state of the national apartment market.

- The total of 45,430 multi-unit completions across the capital cities was 25% below the decade average, with forward modelling and reduced sales volumes anticipating further major reductions over the coming three years. The weak multi-unit sales performance led to an ongoing exodus of investors and pressure on developers from unprecedented construction cost increases, financing challenges and productivity delays.

According to Colin Keane, State of the Land research partner at Research 4, “There is now a level of uncertainty across the market, both from the industry and also the potential customer base. This uncertainty is resulting in lower than modelled levels of activity across markets which is fuelled by the rising cost of living, shrinking household saving rates and changing lending rates. The purchasing power or capacity of the customer is falling with each rate rise, along with the cost of doing business for industry.”

Purchasing power and interest rates are pulling more Australians out of the market at a time when costs continue to increase. Even with an easing in the established market, more pressure is being placed on households to cover their housing costs through their mortgages and in higher rents.

State of the Land research partner CoreLogic’s Eliza Owen commented on the findings: “A strong bounce-back in overseas migration, ongoing strength in rental demand and a peak in the rate hiking cycle are the main tailwinds for the Australian property market in 2023. The main headwinds include household adjustment to high inflation and interest rates, particularly as more mortgages transition from fixed to variable terms over the course of the year.”

UDIA National’s advocacy is keenly focussed on measures that boost supply pipelines across the entire housing spectrum, preparing for the population growth that is necessary for economic recovery, and clearing away the inefficient barriers to dwelling delivery.

“It is the responsibility of all levels of Government to ensure our industry can continue to deliver homes for all Australians and we look forward to continuing our work on the critical issues facing the Australian development industry,” said Maxwell Shifman.

We thank Research4 and CoreLogic who serve as our research partners. Their comprehensive evidence- led work together with UDIA’s on the ground knowledge of the development markets, is the hallmark of this report.

We are especially grateful for nbn‘s on-going support for UDIA and particularly as the State of the Land 2023 Report Major Sponsor.

The full report can be found at this link State of the Land 2023_Digital Version FINAL

–ends–

About the State of the Land Reporting Coverage

State of the Land (SOTL) report has evolved into one of the most comprehensive annual accounts of new residential market activity across Australia’s major capital cities. The core housing data we showcase in this publication is provided exclusively by our Research Partners: Research4 (greenfield land) and CoreLogic (infill/multi-unit dwellings).

Media enquiries, Deanna Lane 0416 295 898 dlane@udiansw.com.au