The flagship “State of the Land” report released today by the Urban Development Industry of Australia (UDIA) highlights the unprecedented levels of demand for new greenfield land, with a record breaking 76,100 lots sold across the combined capital cities in 2021, an increase of 33% over the previous year.

“The frenetic performance of the national greenfield sector has been a critical component of Australia’s strong economic performance through the pandemic. While this has been great news for market confidence and strengthened a housing-led economic recovery, it is also a warning for Governments for the need to act now to ensure development-ready supply is brought online. Failing to do so, and quickly, will impede the economic recovery and further impact housing affordability.” said Maxwell Shifman, National President of UDIA.

Prepared in close partnership with CoreLogic and Research4, the report shows that the COVID period over the last few years has continued to surprise and confound expectations. This is underscored by the unprecedented level of market demand for greenfield lots and new detached housing evidenced across the second half of 2020 and most of 2021.

“The relentless drain on our declining housing supply has brought us to a defining moment, either governments commit to supply boosting initiatives now or accept a deep and prolonged affordability crisis in three years” Mr. Shifman added.

According to the UDIA State of Land research partner Colin Keane from Research4:

“2021 was an all-out assault on the Greenfield supply lines with most markets ending the year with the depleted levels of Active Supply. If 2022 is a continuation of 2021 in terms of activity levels, then the impact will be a widespread loss of housing affordability. 2022 will need to see a moderation in demand in order to allow the market to re-group and re-stock.”

Part of the expressed demand uplift has been the draw-down from a deep pool of pent-up demand in the established housing market, combined with and a pull-forward of demand stimulated by HomeBuilder and other government incentives.

However, increased demand for housing, has exposed historically thin supply lines and together with pandemic-driven materials shortages, has resulted in a further deterioration of supply and affordability.

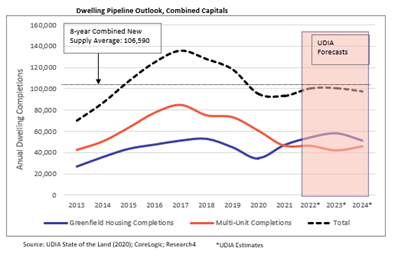

In addition, while activity in the greenfield sector has been intense, the nation’s new multi-unit sector remains subdued with the forward pipeline highlighting the continuing softness of apartment and semi-detached dwelling production impacting national housing over the past few years.

“The forward pipeline for new multi-unit supply (comprising units in the ‘Under Construction’, ‘Approved’ and ‘Early Planning’ categories) across the combined capital cities reduced by 10% across the year, with pipeline contraction recorded in every capital city. As immigration returns and cities begin to live with COVID as endemic, the attributes of apartments to provide greater access and services will re-emerge, with action now needed to meet projected demand,” said Mr. Shifman.

UDIA’s modelling of current and forward pipeline activity indicates there will be a modest aggregate lift in overall production of combined capital city new residential supply* to be delivered in 2022 to total 99,200, remaining at a similar production level in 2023 before declining to 94,600 in 2024.

The forecast volume in 2022 from the combined supply from greenfield corridors and multi-unit and infill completions will be 27% below the output achieved in the peak of 2017 and 7% below the eight– year average achieved between 2013-2021.

Regional Housing Markets have been a major beneficiary through the COVID period, with people moving to the regions for relative housing affordability and given an increased capacity to work from home remotely. This has been particularly acute since restrictions were lifted in October in Sydney and Melbourne, with a demonstrated desire for larger blocks with detached dwellings.

The expectation is for a maintenance of elevated levels of regional population growth and strong dwelling value momentum over the coming two to three years, coupled with a flattening and broadening of markets and values in peri-urban and near city regions.

According to CoreLogic’s latest data, Regional Australia’s combined dwelling values rose 26.1% in the 12 months to January 2022, easily eclipsing the combined capital cities growth of 21.3%.

Tim Lawless Research Director CoreLogic commented:

“After a period of extraordinary growth in housing values, conditions are now slowing across most regions of Australia. Factors such as worsening affordability along with higher costs of living and rising fixed-term mortgage rates are central to the housing slowdown, along with weaker sentiment around the outlook for interest rates and rising global uncertainty.

Looking forward we expect housing conditions will continue to level out as the year progresses, with the potential for housing values to move into a down phase later this year in some regions.”

Notes:

- Since 2017 there has been a steady decline in total new housing supply.

- The evaporation of Net Overseas Migration as a central driver of underlying demand for new housing had many industry analysts gravely concerned for housing market stability and forward pipeline sustainability.

- Demand for new land and detached housing has more than offset the fall in demand from overseas migration and interstate borders being closed.

- The closure of Australia’s international borders in March 2020 exposed capital city housing markets to a unique and re-set demand profile for new residential products.

- Demand has also been impacted by an incredible amount of FOMO in the market. Homebuyers have not been spending during COVID so have cash available to make housing purchase commitments that might not have otherwise been made.

“Australia’s capital cities remain amongst the least affordable cities in the world, and these challenges have now spread to many regional markets. More and more Australians are becoming locked out of the great Australian dream of home ownership.

Now is time to do the hard work needed to bring forward planning and policy reforms to counter Australia’s supply-driven housing affordability crisis and ensure that much-needed infrastructure is delivered to help sustain great cities and regions,” said Maxwell Shifman.

About State of the Land Reporting Coverage

UDIA’s State of the Land report has evolved into one of the most comprehensive annual accounts of new residential market activity across Australia’s major capital cities. The core housing data we showcase in this publication is provided exclusively by our Research Partners: Research4 (greenfield land) and CoreLogic (infill/multi-unit).

UDIA thanks nbn as our national sponsor of the UDIA State of the Land 2022 Report for their valuable support.

Ends

Media: Deanna Lane |National Media & Communications Manager | 0416 295 898 | media@udia.com.au